She Couldn't Buy a Home Until 1974?! The Shocking History Behind Women and Homeownership

Buying a home symbolizes independence, security, and the kind of stability many of us crave. However, for women, the goal of homeownership hasn’t always been simple, or even legally possible. The truth is, we’re still navigating the ripple effects of centuries and patriarchal systemic barriers that attempted to keep us out of ownership altogether. Let’s chat for a moment and break down the cringe-worthy legal and societal barriers that have affected the ability of women to purchase homes.

1. Property Rights? Not until the 1800s.

Until the mid-1800s, married women in many parts of the U.S. literally couldn’t own property. Everything, like seriously everything, legally belonged to their husbands. Yes, this included land, homes, and wages. Yikes. Fortunately, The Married Women’s Property Acts, passed state-by-state starting in 1839, slowly changed that. Progress was slow, but over time, women were able to steadily build wealth and create their own financial footprint through real estate.While we have progressed so much further, it was not that long ago that women weren’t even able to own our own homes without the presence of a man. See the history of women’s rights below to learn more about the systemic obstacles that women faced.

2. Credit Denied: Financial Barriers

Let’s fast forward to the 20th century: while women could legally own property, banks still denied women credit or mortgages without a male co-signer. You heard that correctly: without a husband, father, or family member who happened to be a man, there was no chance of getting a mortgage or credit card. The tides turned after the passage of the Equal Credit Opportunity Act of 1974 (yes—1974!), which allowed women to obtain a mortgage without needing a male co-signer.

This means that women have truly only been legally allowed to build credit in the US for barely over 50 years. So when your grandma or aunt talks about how they weren’t able to buy their own home, this is a big reason why. Some of our moms weren’t even able to purchase a home on their own in their 20s and 30s. These financial barriers weren’t just unfair; they truly delayed generations of women from building wealth and stability.

3. Discrimination in the Housing Market

Redlining and other discriminatory practices have harmed communities of color and especially women of color for years. Banks, landlords, and even real estate agents often refused to sell or rent to single white women and women of color because they were assumed to be “unreliable” buyers or tenants.

Today, bias lingers with a more subtle undercurrent. Studies have shown that women, particularly Black and Latina women, are still quoted higher mortgage rates and are still more likely to be denied loans at a higher rate than their male counterparts.

4. The Gender Pay Gap Strikes Again

You can’t mention systemic barriers to homeownership without addressing income. We all already know that the gender pay gap is alive and well. Women still make roughly 82 cents for every dollar earned by men, and it becomes even more pronounced for women of color. This pay gap equates to more difficulty saving for down payments, qualifying for loans, and affording rising housing prices.

This isn’t just a statistic; it is a serious barrier, as your income directly determines the size and quality of home you can afford, and even whether you can buy one at all.

5. The Myth of “Waiting it Out”

There’s a long-standing societal belief that women should wait until marriage to buy a home, as if homeownership only makes sense when you're part of a romantic couple. Nowadays, more and more women are flipping the script and challenging that belief. Women are buying homes on their own, buying with friends, and even partnering with siblings for real estate investments. You do not need a romantic partner to own a home!

If you’ve ever felt pressured to “wait until everything is perfect,” please know that this mindset is outdated. You can prepare to buy a home with or without a partner, on your own terms.

So, Where Are We Now?

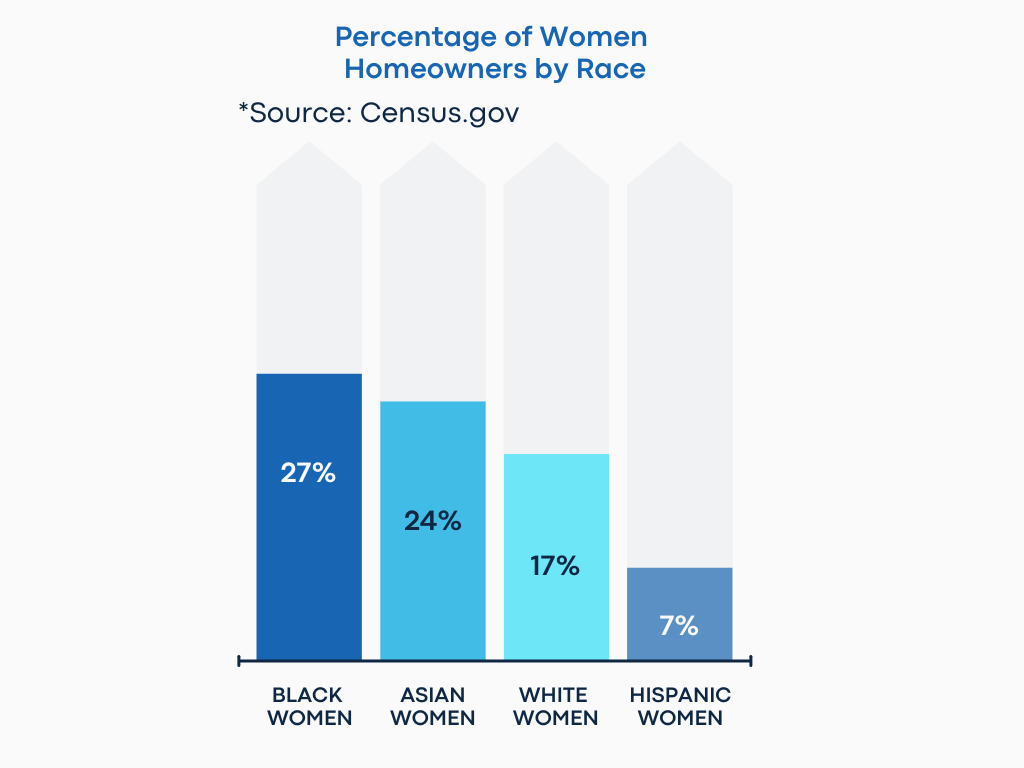

Despite the systemic obstacles that have stood in our way, it is encouraging to note that today, single women are actually buying homes at nearly twice the rate of single men. Check out the progress of single women homeowners in the graph below!

Graph of women homeowners by race.

But it’s also important to acknowledge the U.S.’s history of exclusive laws towards women, because some of these challenges still exist today.

When you understand the historical headwinds that tried to prevent women from owning homes, every step toward ownership feels that much more revolutionary. We are not just buying a house; we are breaking cycles, rewriting narratives, and building a legacy.

Want tips on how to prepare for your first home purchase? Stay tuned for our guide for first-time women homebuyers!